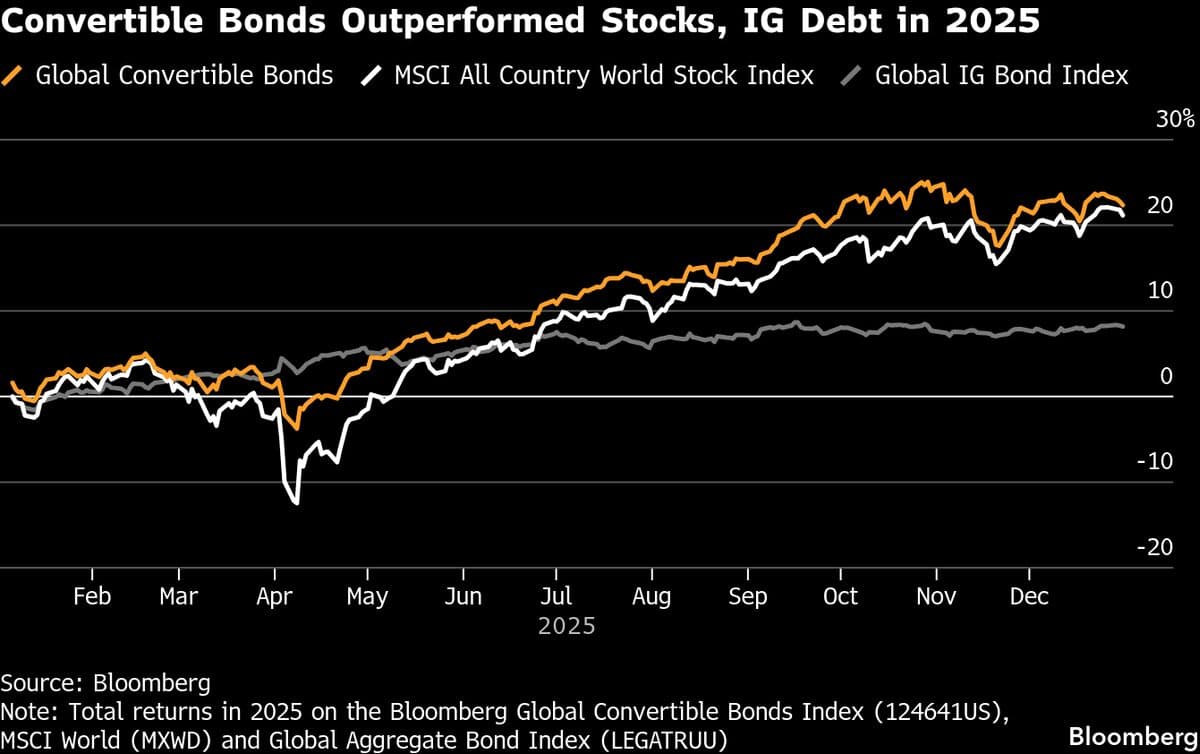

AI Spending Boom Fuels 24-Year High for Convertible Bond Deals

🤖AI Özeti

The global market is witnessing a surge in convertible bond issuances, reaching a 24-year high, driven primarily by the rapid advancements in artificial intelligence. This trend reflects a growing demand for more affordable financing options among companies. As businesses look to capitalize on AI developments, convertible bonds are becoming an attractive financial instrument.

💡AI Analizi

📚Bağlam ve Tarihsel Perspektif

Convertible bonds allow companies to raise capital while providing investors with the option to convert bonds into equity, making them a flexible financing tool. The rise in AI investment has created a favorable environment for such financial instruments, as firms aim to fund innovative projects without incurring high debt levels.

This article is for informational purposes only and does not constitute financial advice.

Orijinal Kaynak

Tam teknik rapor ve canlı veriler için yayıncının web sitesini ziyaret edin.

Kaynağı Görüntüleİlgili Haberler

Tümünü GörNewsAI Mobil Uygulamaları

Her yerde okuyun. iOS ve Android için ödüllü uygulamalarımızı indirin.