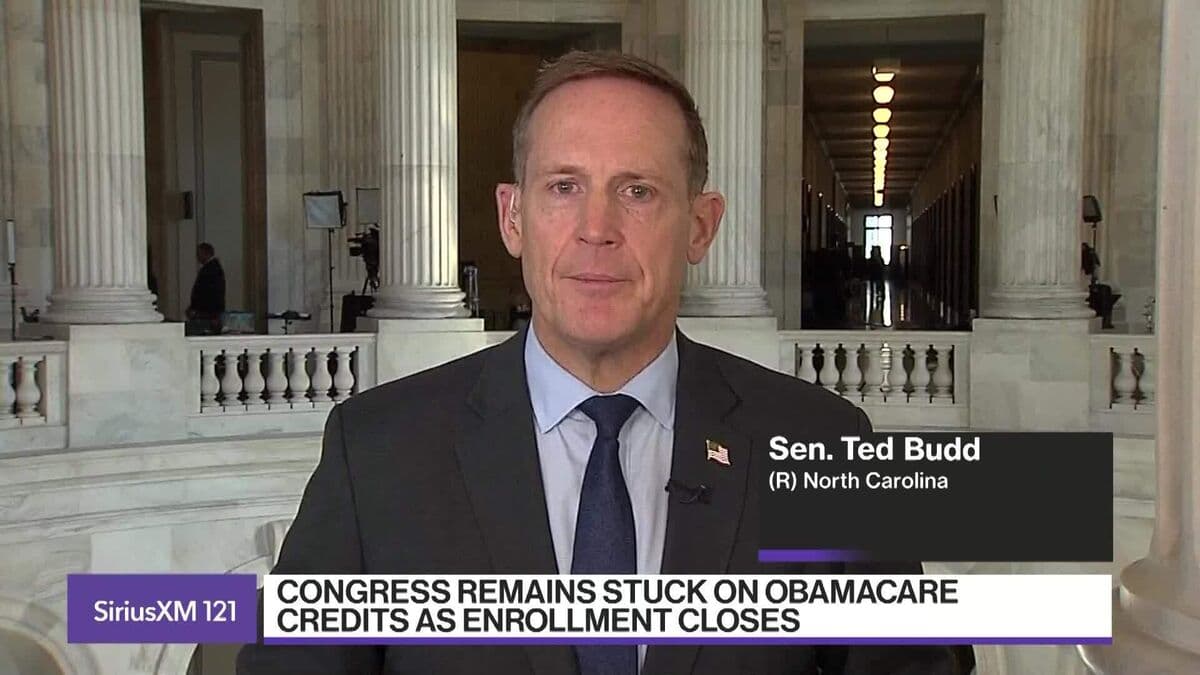

Credit Card Rate Caps 'Bad Idea,' Would Hurt Consumers, Says Sen. Budd

🤖AI Özeti

Republican Senator Ted Budd criticized the proposal to cap credit card interest rates, arguing that it could limit access to credit for consumers who need it. He also expressed his belief that the Senate should not continue to support expanded Obamacare subsidies, suggesting an alternative approach that would provide direct financial assistance to the public. Budd's comments reflect a broader debate about consumer protection and financial accessibility.

💡AI Analizi

📚Bağlam ve Tarihsel Perspektif

The discussion around capping credit card interest rates comes amid ongoing debates about consumer debt and financial regulation in the United States. As many Americans face rising costs of living, the accessibility of credit remains a critical issue. Budd's remarks also tie into larger conversations about healthcare funding and the role of government in providing financial support.

This article is based on statements made by Senator Ted Budd and does not necessarily reflect the views of Bloomberg or its affiliates.

Orijinal Kaynak

Tam teknik rapor ve canlı veriler için yayıncının web sitesini ziyaret edin.

Kaynağı Görüntüleİlgili Haberler

Tümünü GörNewsAI Mobil Uygulamaları

Her yerde okuyun. iOS ve Android için ödüllü uygulamalarımızı indirin.