Eurizon, SocGen Bet on Yen Rebound as Intervention Risks Lurk

🤖AI Özeti

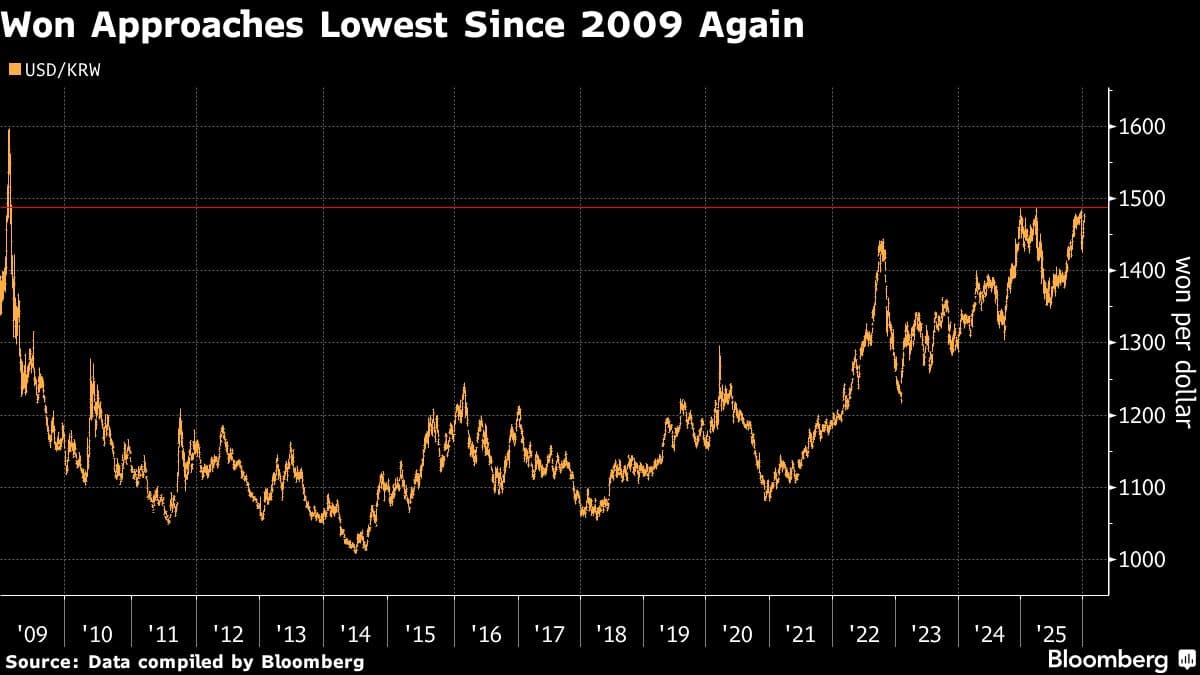

Eurizon SLJ Capital and Societe Generale SA have noted that the yen's recent decline heightens the chances of government intervention and a potential market correction. This trend has raised concerns among investors about the stability of the currency. Analysts are closely monitoring the situation as the yen's performance could significantly impact global markets.

💡AI Analizi

📚Bağlam ve Tarihsel Perspektif

The yen has been on a downward trajectory, prompting discussions about potential intervention by the Bank of Japan. Historically, such interventions have aimed to stabilize currency fluctuations, but they can also lead to unintended consequences in the broader financial landscape.

This article is for informational purposes only and does not constitute financial advice.

Orijinal Kaynak

Tam teknik rapor ve canlı veriler için yayıncının web sitesini ziyaret edin.

Kaynağı Görüntüleİlgili Haberler

Tümünü GörNewsAI Mobil Uygulamaları

Her yerde okuyun. iOS ve Android için ödüllü uygulamalarımızı indirin.