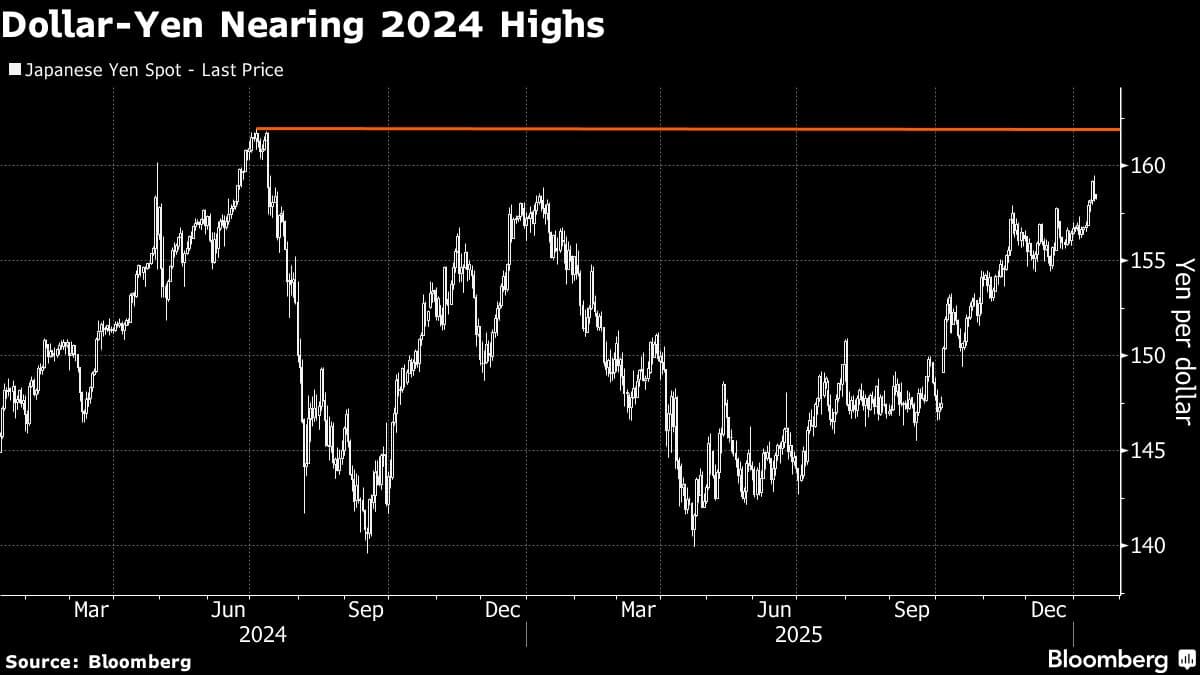

Hedge Funds Are Betting Yen May Slide to 165 Before Intervention

🤖AI Özeti

Hedge funds are taking a bold stance against the Japanese yen, betting that it could decline to 165 against the dollar before any government intervention occurs. This strategy highlights a growing confidence among investors that the yen's downward trajectory may continue despite warnings from Japanese authorities. As these funds engage in currency option markets, they signal a potential shift in market sentiment regarding the yen's stability.

💡AI Analizi

📚Bağlam ve Tarihsel Perspektif

The Japanese yen has been under pressure due to various economic factors, including interest rate differentials and global market dynamics. Recent warnings from Japanese authorities about potential intervention suggest a heightened concern over the currency's depreciation. However, hedge funds appear to be betting that the yen will continue to weaken, reflecting a complex interplay of market confidence and governmental response.

This article is for informational purposes only and does not constitute financial advice.

Orijinal Kaynak

Tam teknik rapor ve canlı veriler için yayıncının web sitesini ziyaret edin.

Kaynağı Görüntüleİlgili Haberler

Tümünü Gör

How a former U.S. special forces officer raised $22 million for his cybersecurity startup

15 Ocak 2026

Seizing Greenland risks 'monumental' fallout, ex-Iceland president warns, as Trump sharpens rhetoric

15 Ocak 2026

Russian attacks cause energy emergency in freezing Ukraine, says Zelenskyy

15 Ocak 2026NewsAI Mobil Uygulamaları

Her yerde okuyun. iOS ve Android için ödüllü uygulamalarımızı indirin.