Stock Market Stands on Side of History If Japan Elections Called

🤖AI Özeti

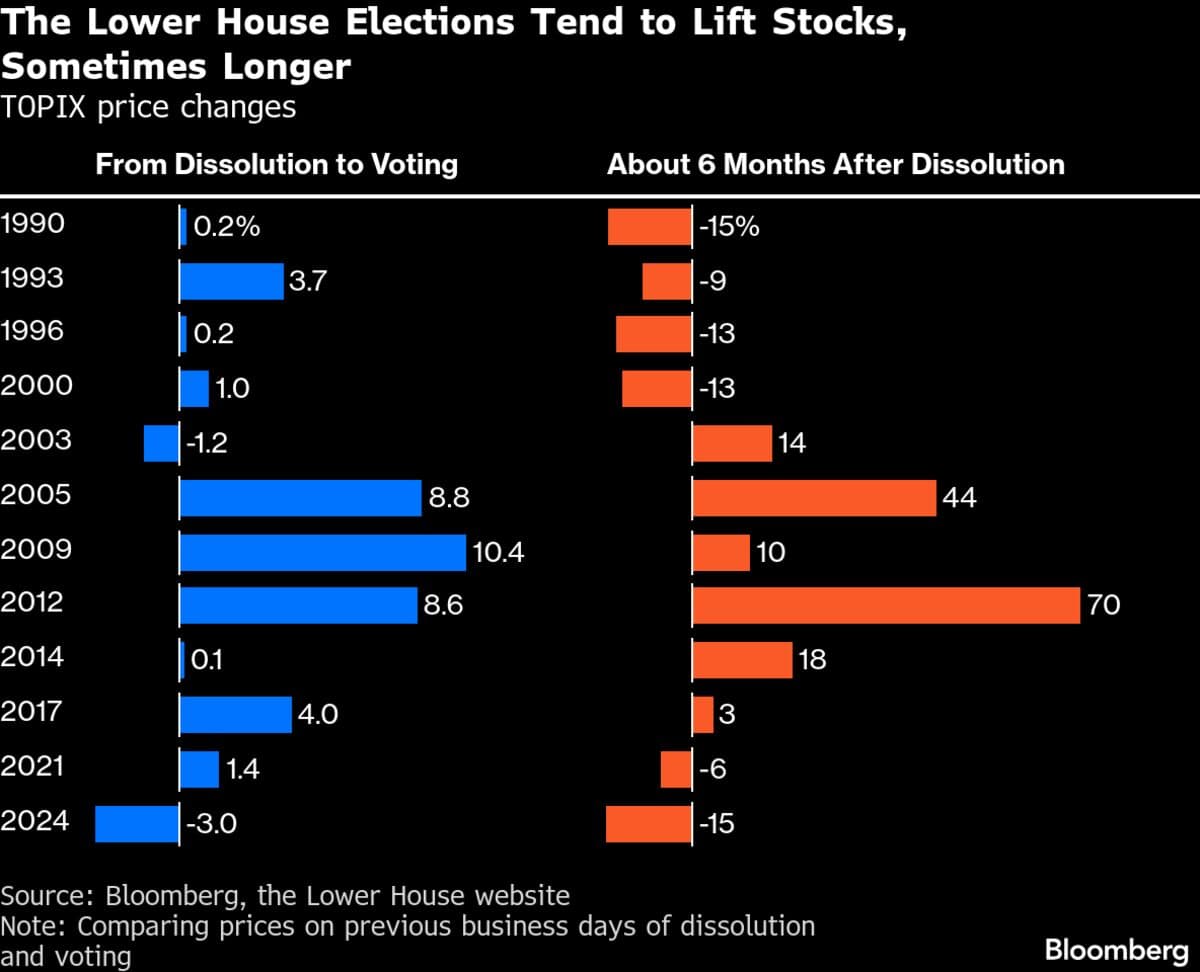

Local media reports suggest that Prime Minister Sanae Takaichi may call a snap election. Historical trends indicate that such elections tend to favor stock market investors, particularly in the short term. This potential political move could create a favorable environment for market gains as investors respond to the uncertainty and opportunities presented by the election.

💡AI Analizi

📚Bağlam ve Tarihsel Perspektif

Japan's political landscape has been characterized by a series of elections and shifts in leadership, which often impact economic policies and investor sentiment. The potential for a snap election adds another layer of uncertainty, but historically, such events have resulted in short-term market gains as investors react to the news.

This analysis is based on historical trends and does not guarantee future market performance.

Orijinal Kaynak

Tam teknik rapor ve canlı veriler için yayıncının web sitesini ziyaret edin.

Kaynağı Görüntüleİlgili Haberler

Tümünü GörNewsAI Mobil Uygulamaları

Her yerde okuyun. iOS ve Android için ödüllü uygulamalarımızı indirin.